Streamlined sales tax (SST) refers to an initiative started in 1999 focused on simplifying and modernizing sales and use tax collection and administration for businesses operating in multiple U.S. states.

The Streamlined Sales Tax Project (SSTP) was launched in 1999 as a voluntary initiative spearheaded by state governments. It arose from concerns that the existing sales tax system applied unevenly on traditional brick-and-mortar retailers compared to mail order and online retailers.

The rise of e-commerce exposed flaws in the sales tax physical nexus rules at the time. Under the Supreme Court’s 1992 Quill decision, sellers were only required to collect sales tax in states where they had a physical presence such as stores, warehouses or employees.

Online retailers with no physical presence in a state could sell goods tax-free to residents of that state, undercutting local retailers forced to collect sales tax. States dependent on sales tax revenue were losing out in the rapidly growing e-commerce sector.

The SSTP was conceived as a state-led effort to modernize and simplify sales tax policies, easing the burden on retailers of multistate compliance while also “leveling the playing field” between online sellers and brick-and-mortar businesses.

The initiative would develop a streamlined system that could ultimately be adopted on a voluntary basis by states across the country.

The Streamlined Sales Tax Project aims to deliver the following major benefits:

The varying sales tax rules across states impose enormous complexity and costs for retailers operating in multiple jurisdictions. Streamlining brings uniformity to tax bases, rules, filing procedures, and definitions which simplifies multi-state compliance.

Simplified systems, common definitions, centralized registration, and innovative technologies improve the efficiency and lower the cost of tax administration for states. It also facilitates tax collection from online and remote sellers.

A more consistent system applies to both online sellers and brick-and-mortar retailers, eliminating potential distortions or biases. It levels the playing field for all types of retailers.

With a simplified system that facilitates tax collection across all types of retail transactions, states can shore up fiscal shortfalls and erosion of the sales tax base. This benefits state and local governments.

The changes enable states to effectively tax major retailers operating remotely across state lines and other e-commerce transactions.

To deliver these benefits, the Streamlined Sales and Use Tax Agreement (SSUTA) contains various requirements that participating states must implement. Let's look at some of the major features.

Under SSUTA, sales and use tax must be administered solely at the state government level rather than individual local jurisdictions being allowed to control taxes and audits.

The state handles tax collections and distributions to local governments, creating a centralized system for retailers. Local governments cannot conduct independent tax audits on retailers either.

Member states must align tax bases across state and local jurisdictions. With limited exceptions, the same basket of goods and services must be taxed or exempted statewide to minimize complexity.

SSUTA aims to simplify the myriad of state and local tax rates across the country. At the local level, jurisdictions can only have a single tax rate with few exceptions.

While a state can have up to two bracketed rates, most states will have a single statewide rate. Changes to rates can also only occur on the first day of a calendar quarter.

A key source of complexity is differing definitions of taxable and exempt goods and services across states. The SSUTA establishes standardized definitions for key terms, products, and services.

Over 100 categories like computer software, digital goods, clothing, and food have standardized definitions. This allows retailers to more easily interpret tax laws.

The SSUTA calls for an online centralized registration system where retailers can register for sales tax in member states rather than deal with individual state systems. Retailers complete a simplified application process and can quickly register in any desired member states.

Under SSUTA, standardized sourcing rules determine which tax rates apply and where revenue should go. This prevents multiple states trying to tax the same sale. Sourcing is generally destination-based for interstate sales.

These are third-party software providers certified under the SSUTA to handle sales tax compliance, filing, and remittance for retailers. States provide financial allowances to encourage CSP usage and relieve retailers of tax processing burdens.

To deliver these benefits, SSUTA contains various requirements for participating states. However, the agreement preserves state sovereignty and does not override state laws.

Since SST is a voluntary initiative, states must choose to participate and adopt the necessary system changes.

The advantages of membership include simpler tax administration, access to innovative technologies, increased state sales tax revenues, and more equal treatment of retailers within their state.

Let's look at the steps involved for a state to join the streamlined sales tax initiative.

The first key step is for a state to enact legislation and regulations needed to conform its existing sales tax system with the requirements under the SSUTA.

This ensures the state has uniform tax bases, simplified rates, centralized administration, destination sourcing, and other mandatory streamlined provisions in law.

Some examples of changes needed could include:

The specific amendments depend on the gaps between the state’s existing sales tax system and SSUTA requirements. States have flexibility in how their legislation is structured as long as SSUTA compliance is achieved.

Petitioning states also need to complete an online Certificate of Compliance which outlines their conformance with each specific provision of the SSUTA.

References to updated laws and regulations demonstrating compliance must be provided. The matrix also identifies where the state deviates from SSUTA requirements and why.

The state must also fill out the online taxability matrix indicating the tax treatment and sourcing of key products, services, and transactions. This aids retailers in understanding where items are taxable.

Technology plays a pivotal role in streamlined sales tax. Petitioning states need to demonstrate that their IT systems and interfaces align with SSUTA technical standards.

This testing verifies that the state can:

Any technology gaps or issues need resolution before applying for membership.

Once legislative compliance is achieved and technology capabilities confirmed, the state is ready to formally apply for SST membership by submitting a petition.

The application is then voted on by existing member states. Approval requires a three-fourths majority vote.

If accepted, the effective date of membership depends on the state's readiness but must be the start of a calendar quarter at least 60 days after approval.

The petitioner must also pay a $20,000 fee upfront which is refunded if the petition gets rejected. This helps fund the application review process.

With these steps completed, the state can become a full member of the Streamlined Sales Tax initiative. Ongoing compliance is required and states must be recertified annually.

|

| SST Member Sates |

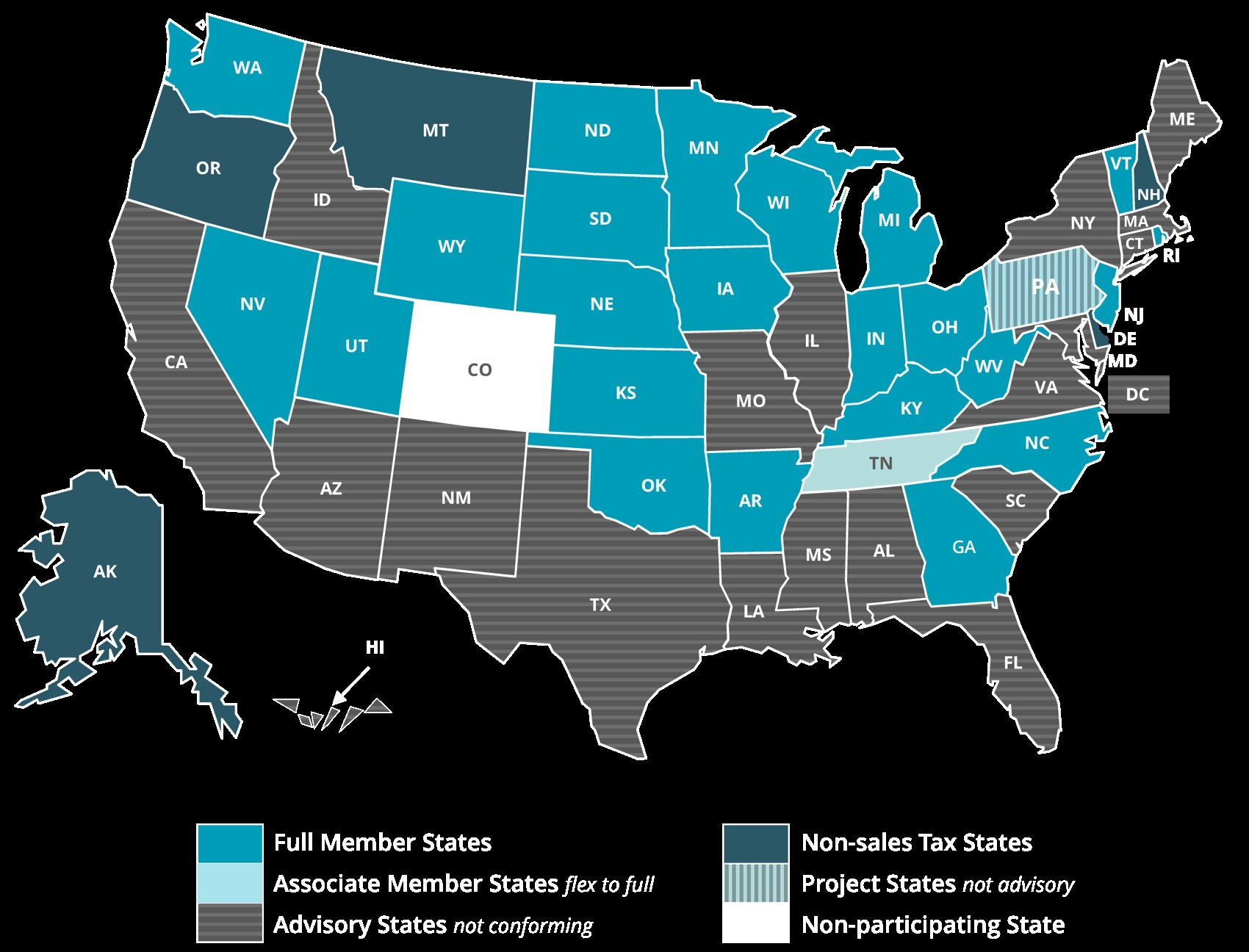

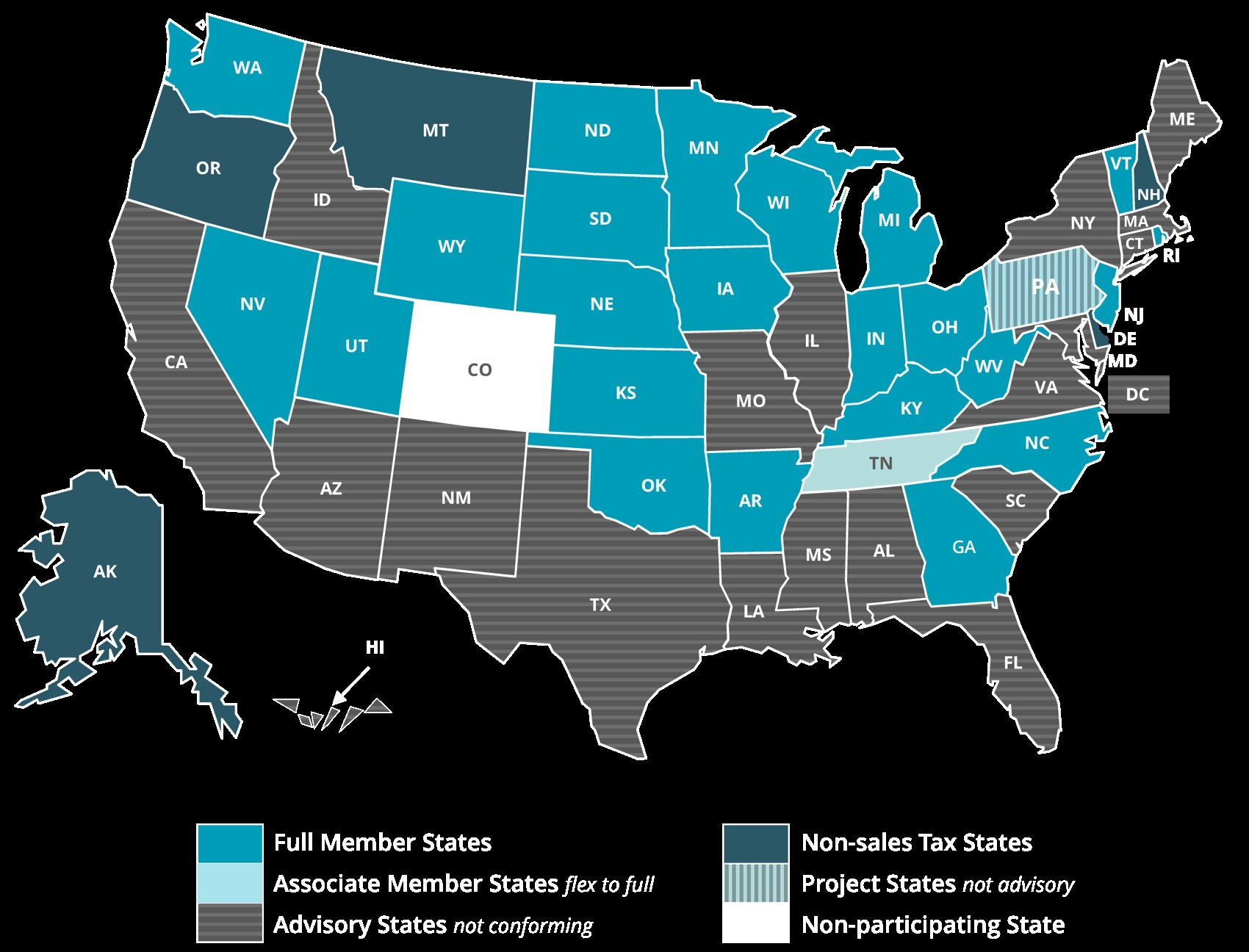

There are different tiers of SST state membership reflecting varying levels of compliance with the agreement. Let's examine the requirements and privileges under each:

This is the highest level of membership indicating a state is in full compliance with the SSUTA provisions. Key privileges include:

Full members must continue to adhere to SSUTA terms to retain member status. They undergo annual recertification and may face sanctions like demotion or expulsion if significant noncompliance is uncovered.

States that achieve substantial yet incomplete compliance can attain associate member status, for example, if major legislative changes are still pending enactment.

Associate members cannot vote on SSUTA changes and amendments. They also do not participate in CRIC or receive CSP seller data. But they appoint two board delegates and access the central registration system.

States whose SSUTA conforming changes are not yet in legal effect but will be within 12 months of joining can attain contingent status.

They receive the same privileges as associate members until coming into full compliance.

States showing commitment to developing a simplified sales tax system but which are still in early stages can be advisors to the SSTP. They can appoint non-voting board delegates.

The SSUTA establishes rigorous processes to monitor ongoing member compliance:

This vigilance aims to assure retailers that states uphold SSUTA commitments over time. It also maintains the integrity of the initiative.

How do the changes ushered in by the streamlined sales tax project impact companies? Let's look at the effects on retailers along with benefits they can leverage.

With simplified centralized registration, retailers can easily expand their registered filing obligations to additional streamlined states as their sales grow.

Uniform definitions, rates, rules, and administration slash the workload of managing multi-state sales tax filing. This reduces compliance costs for retailers.

Access to approved certified service providers and automated sales tax solutions improves filing accuracy while lightening the technology burden.

Retailers can depend on rate and boundary databases in SSUTA states to get the right tax jurisdiction and applicable rates. Liability relief protects retailers who rely on these databases provided by states.

Easier registration and compliance means retailers can focus more resources on customers rather than sales tax processing.

Of course, the expansion of streamlined sales tax to more states over time will further amplify these benefits.

One of the most useful Streamlined Sales Tax features for businesses is the centralized online registration system available at https://www.sstregister.org/.

This portal provides a single application process that retailers can use to quickly and easily register for sales tax in any of the SST full member states. Key capabilities include:

The centralized system removes the need for retailers to interact separately with each state’s registration processes. Registration in additional states can be handled seamlessly as a business grows.

It’s important to note that once registered in a streamlined state via this system, the retailer does take on the obligation to collect, report and remit applicable sales tax for that state. They cannot continue selling tax-free if below state nexus thresholds.

Many retailers find the process of collecting, filing and remitting sales tax across multiple states highly complex and burdensome. Keeping up with changing tax rates, rules and boundaries is challenging.

To ease this burden, the SSUTA introduces Certified Service Providers (CSPs) - private sector companies that are certified to handle all sales tax filing, remittance and related services for retailers. These CSPs maintain extensive tax detail for all SST member states.

There are a few ways retailers can leverage CSPs:

States provide monetary allowances to CSPs to encourage retailer use of their services. For smaller retailers without physical nexus in a state, the state pays the CSP charges.

Using CSPs also immunizes retailers from audit liability which gives retailers added peace of mind.

It’s taken over 20 years, but streamlined sales tax has now reached a mature state with 24 U.S. states having achieved full membership. However, there remains room for further expansion.

With many states now enacting economic nexus laws after the Supreme Court’s 2018 Wayfair decision, interest in further simplification through initiatives like Streamlined may increase.

Some potential future developments include:

If difficult nexus compliance burdens start impacting more states and retailers, this could spur additional states to streamline their sales tax systems and join SST. Already, participation has doubled from the initial 13 states in 2005.

Efforts for federal intervention may occur if substantial differences persist across state sales tax rules leading to continued complexity for interstate commerce.

New solutions like artificial intelligence could help facilitate automated cross-state sales tax compliance and auditing leveraging streamlined tax rules coded into systems.

With more competitive pressure, CSPs could harness advanced technologies like machine learning to further simplify sales tax filing for retailers.

While predictions are difficult, the simplification and expansion of streamlined sales tax membership appear to be likely trends in the long-term based on evident directional momentum.

For retailers struggling with managing multi-state sales tax, embracing certified service providers and eventual expansion of streamlined rules to additional states both hold potential to alleviate key pain points.

The Streamlined Sales Tax initiative has come a long way over 20 years through the methodical efforts of proactive state governments seeking to modernize sales tax administration.

Although complex to implement, this voluntary initiative has provided simpler, more efficient sales tax systems now active across nearly half of U.S. states.

Retailers and states have already experienced concrete benefits from streamlined tax bases, centralized registration, common rules, rate databases, liability relief, certified service providers, and innovative technologies.

As streamlined sales tax continues maturing into the future, businesses can look forward to improved sales tax compliance processes and hopefully reduced burdens from cross-border interstate commerce.